Tax interest calculator

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Accrued Interest What It Is And How It S Calculated

The child tax credit starts to phase out once the income reaches 200000 400000 for joint filers.

. To understand and compare the different ways in which interest can be. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Charitable contributions mortgage interest and investment interest are all deductible.

You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately. Where you reside and the potential rate of return on any investments. 2021 Personal income tax calculator Enter your.

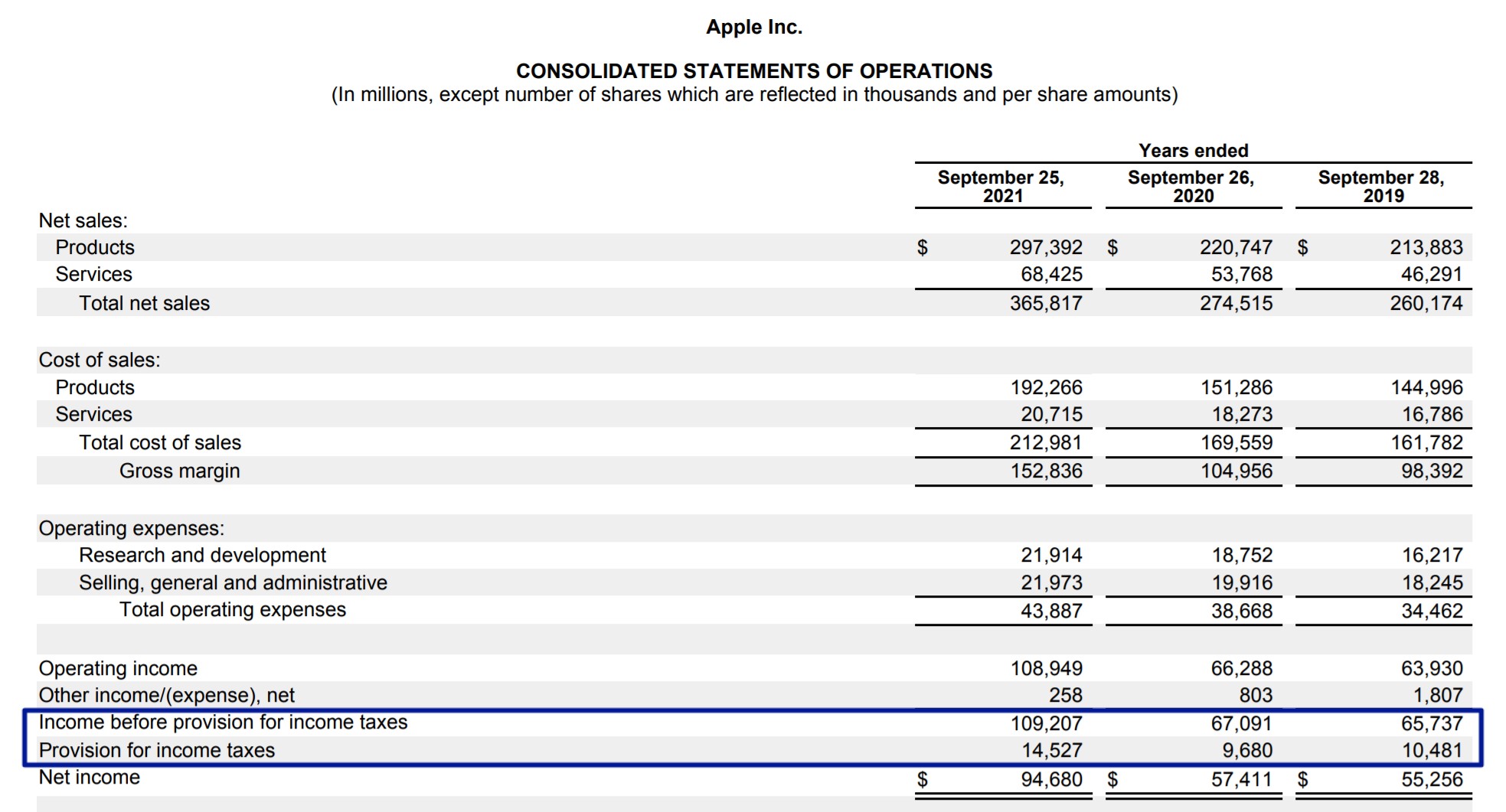

For taxpayers who use married filing separate status the. From there well take your revenues and subtract out your expenses and then apply the correct tax rate to come up with an estimate of what you should be paying for taxes. More details about Singapore Resident Tax Rates can be found here.

If you win big its in your best interest to work with a financial advisor to determine whats right for. Recommends that taxpayers consult with a tax professional. If transfer takes place after July 10 2014 the concessional rate of 10 will not be available in case of LTCG which arises on transfer of units.

Qualified business income non-taxable income eg. 202223 Tax Refund Calculator. Addition to Tax and Interest Calculator Please enter the date your taxes were due the date filed the estimated payment date and the amount owed.

Correct information is crucial in making an. Interest from municipal. This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on tax debt.

If you decide to complete and sign your tax return most people finish in just minutes our qualified accountants check your return and look for suggestions about further deductions or adjustments that can boost your. You owe a sizable tax bill and havent made any estimated payments. Tax Rates vary depending on the tax so unlike the interest rates tax rates are separated and listed by tax type.

Penalties and interest for personal income tax. The Interest Rates section identifies interest rates for the late payment of tax and includes instructions on how to calculate interest due. This section applies to all tax types.

Computation of these amounts is based on application of the law to the facts as finally determined. High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and phased-out exemptions not shown here in addition to paying a new 396 tax rate and 20 capital gains rate. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

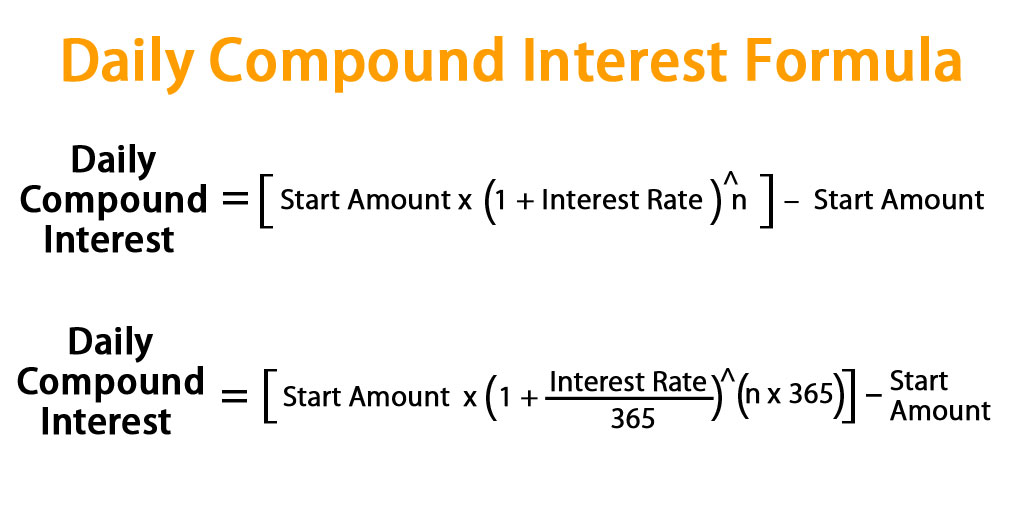

Enter decimals with your tax due with no dollar sign. Our IRS Penalty Interest calculator is 100 accurate. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

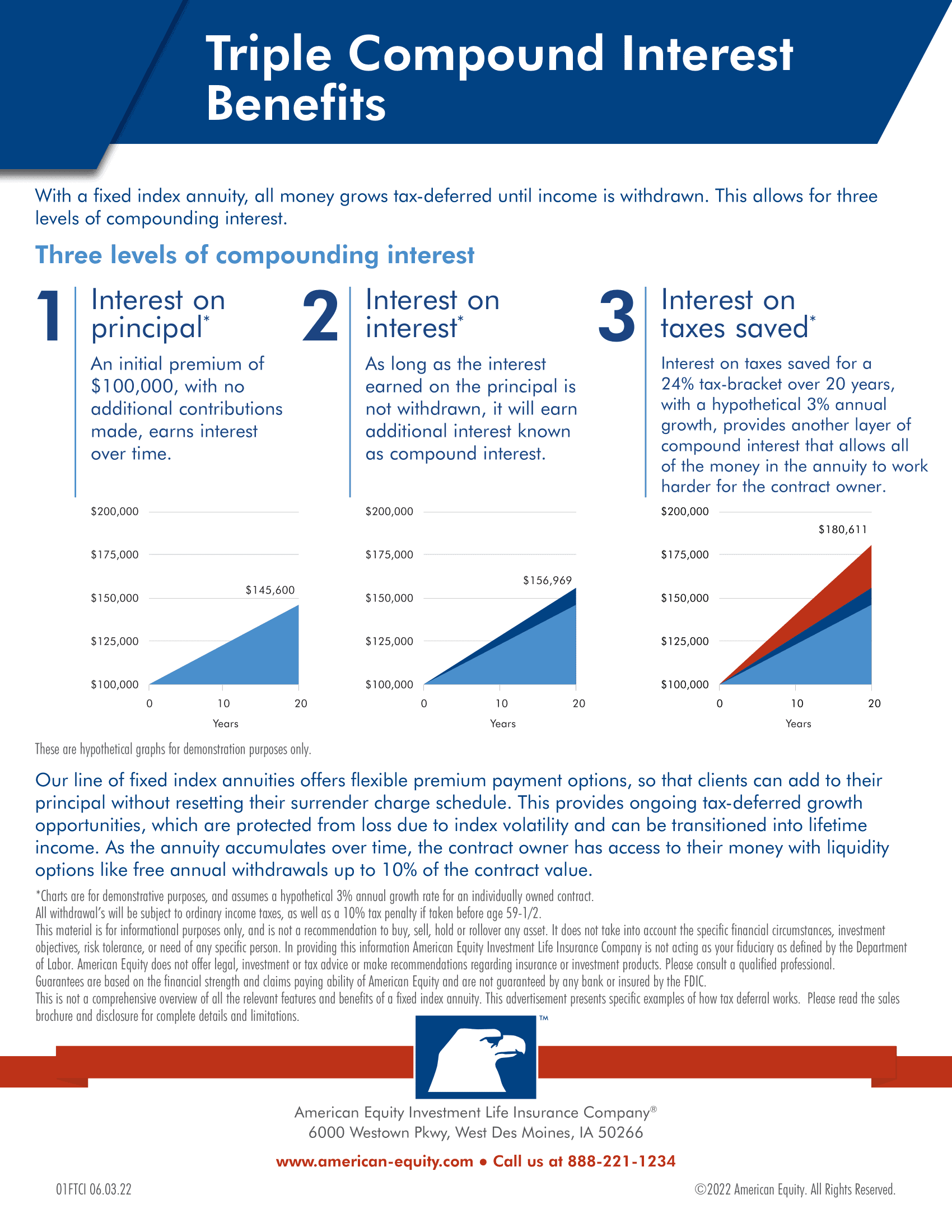

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. This is when a lottery tax calculator comes handy. Foreign Tax CreditThis is a non-refundable credit that reduces the double tax burden for taxpayers earning income outside the US.

Enter the security code displayed below and then select Continue. Our sole and only guarantee or warranty is that anyone who. Child Tax CreditIt is possible to claim up to 2000 per child 1400 of which is refundable.

Your household income location filing status and number of personal exemptions. If you are the lucky winner you still have to worry about bills and taxes. You dont expect to have much or any self-employment income next year.

In most cases your employer will deduct the income tax from your wages and pay it to the ATO. A mortgage calculator can help you determine how much interest you paid each month last year. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions.

Our small business tax calculator uses the figures provided to estimate your tax expenses. HELOCs are no longer eligible for the deduction unless the proceeds are used to buy build or substantially improve a home. The following security code is necessary to prevent unauthorized use of this web site.

For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. The Online Calculator for Interest and Additions to Tax Tax Calculator is designed to assist Taxpayers in calculating interest and additions to tax due relating to West Virginia tax liabilities. The standard deduction in Arkansas is lower than the federal standard.

What is the personal income tax rate in Singapore. Recommends that taxpayers consult with a tax professional. These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

Penalty and Interest Calculator. Long Term Capital Gains Covered under section 112A Note. The Tax Return Calculator is a free part of the Etax online tax return a paid tax agent serviceThe calculator provides an instant estimate of your tax refund or payable.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. The list below includes the most common taxes the Florida Department of Revenue administers. TurboTax Personal Tax Calculator Tools Tax Refund Calculator.

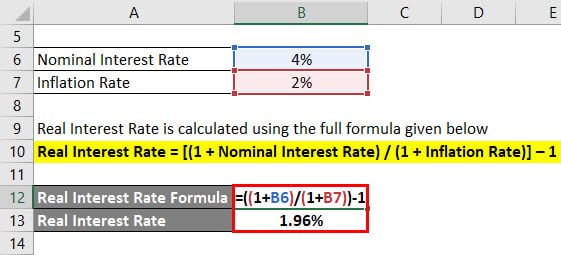

Personal income tax audits. There are also optional factors available for consideration such as the tax on interest income and inflation. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year.

The highest personal income tax rate of 22 are for individuals with an annual taxable income of more than 320000. In this situation reducing your tax liability by prepaying expenses is a good idea. Estimate your 2022 refund taxes you file in 2023 with our tax calculator by answering simple questions.

Tax Changes for 2013 - 2022. How do I know if I am a tax resident of Singapore. Singapores Personal Income Tax rate ranges from 0 to 22.

The provided calculations do not constitute financial tax or legal advice. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. The lower your tax liability the less youll pay in underpayment penalties and interest.

Please use the same date format used below. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Long Term Capital Gains Charged to tax 10 V.

Personal income tax rates and tables. Interest payable on loan for purchase of electric vehicles us 80EEB g. Jump to the Lottery Tax Calculator.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document.

Compound Interest Calculator Daily Monthly Quarterly Annual

Daily Compound Interest Formula Calculator Excel Template

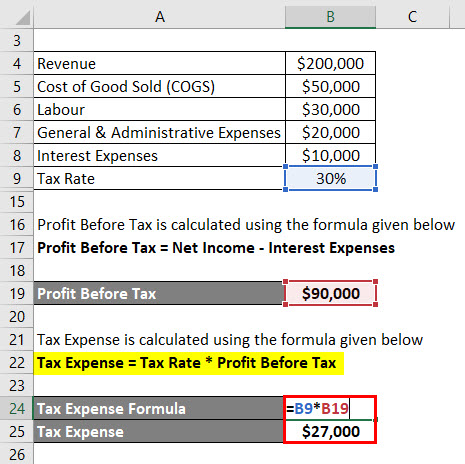

Tax Shield Formula Step By Step Calculation With Examples

Effective Tax Rate Formula And Calculation Example

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculator

Interest Tax Shield Formula And Calculator

Real Interest Rate Formula Calculator Examples With Excel Template

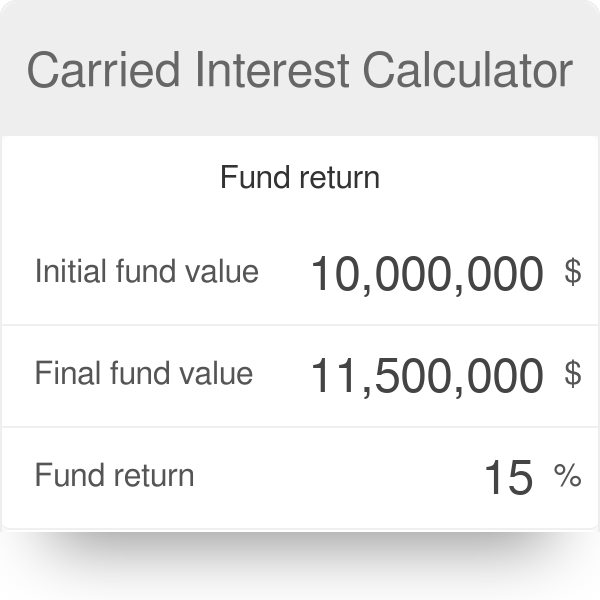

Carried Interest Calculator And Formula

Tax Shield Formula Step By Step Calculation With Examples

Tax Calculator Estimate Your Income Tax For 2022 Free

Compound Interest Calculator Daily Monthly Quarterly Annual

Nopat Formula How To Calculate Nopat Excel Template

Tax Shield Formula Step By Step Calculation With Examples

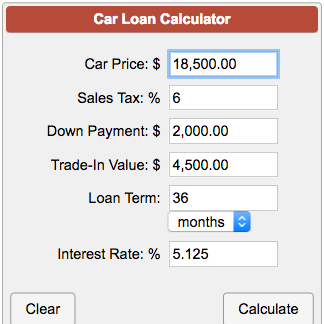

Car Loan Payment Calculator

Cost Of Debt Kd Formula And Calculator

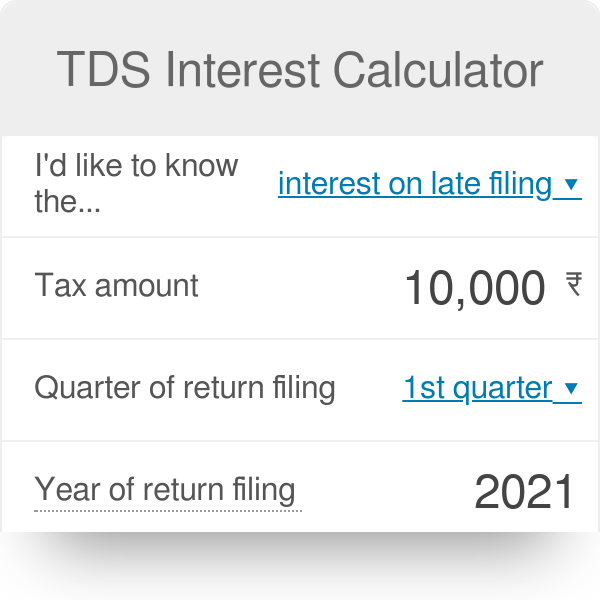

Tds Interest Calculator